san francisco payroll tax withholding

Choose Non-UC External User if you are not a UC or UCOP employee. Summary of Payroll Tax Limits FEDERAL INSURANCE CONTRIBUTION ACT FICA.

2022 Federal State Payroll Tax Rates For Employers

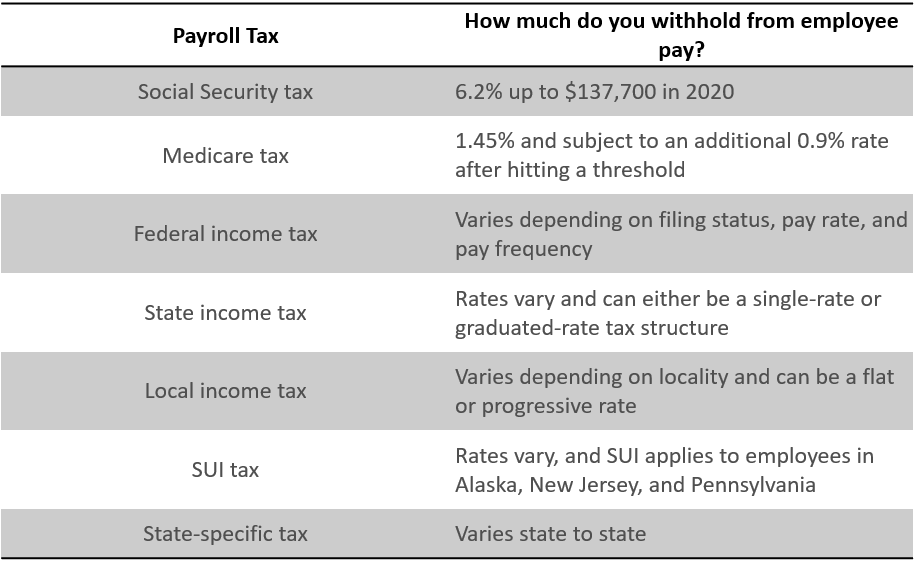

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS.

. Listen as the presenter discusses solutions to how your. Zenefits is an award-winning People Ops Platform that makes it easy to manage your employee documents HR benefits payroll time and attendance and benefits all in one secure place. Accounting CS version date Effective date State or.

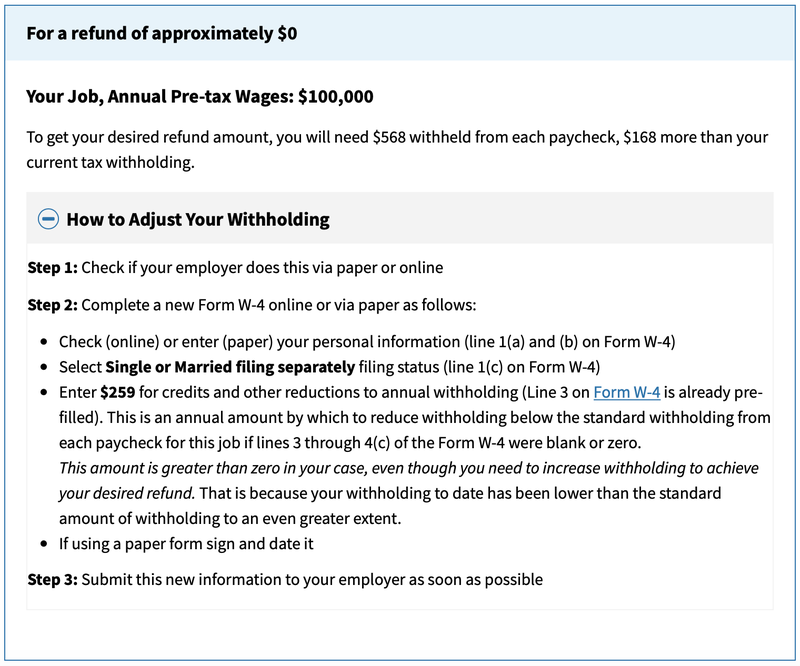

The Federal Tax Cuts and Jobs Act PL. Software updates and optional online features require internet. A refund may also impact your claim to CCSF retiree health benefits.

Keeping your taxes as low as allowable by law protecting your assets and maximizing tax deductions within IRS tax compliance is our focusTax. About Payroll Self Service. Since 2013 thousands of Canadians have used Plastiq to pay their CRA taxes with their credit cards.

2021 2020 Social Security Tax Maximum Wage Base 142800 137700 Maximum Social Security Employee Withholding 885360 853740 Social Security RateEmployer 62 62 Social Security RateEmployee 62 62 Medicare Tax Maximum Wage Base No limit No limit. Payroll Information 2021-22 Steady Crane Operator Calendar 2020-21 Steady Crane Operator Calendar 2021 Holiday Calendar 2020 Holiday Calendar 2022 Payroll Week Calendar 2021 Payroll Week Calendar 2019-20 Steady Crane Operator Calendar Pay Shortage Claim Form Frequently Asked Questions Payroll Self Service About Payroll Self Service Direct Deposit Enrollment and. Choose Office of the President UCOP only if you are a UCOP employee.

Normally tax withholding is taken care of by your employer and you dont have to think about it says Rachel Elson an associate financial planner at. E-file fees do not apply to New York state returns. Raff director of the tax department at Northfield Illinois-based Gordon Law Group Ltd said those moves can have implications for income sales and payroll taxes depending on the.

It is essential to always report all of your 1099 forms when completing your tax return to ensure backup withholding is not an issue. Savings and price comparison based on anticipated price increase. Payroll tax to fund long-term care program Under the law which was passed in 2019 workers will pay a premium of 58 of total pay per paycheck meaning an employee with a salary of.

HR Payroll Benefits. End-to-end onboarding accomplished in minutes. Our easy paperless online payroll is a complete solution for businesses of any size.

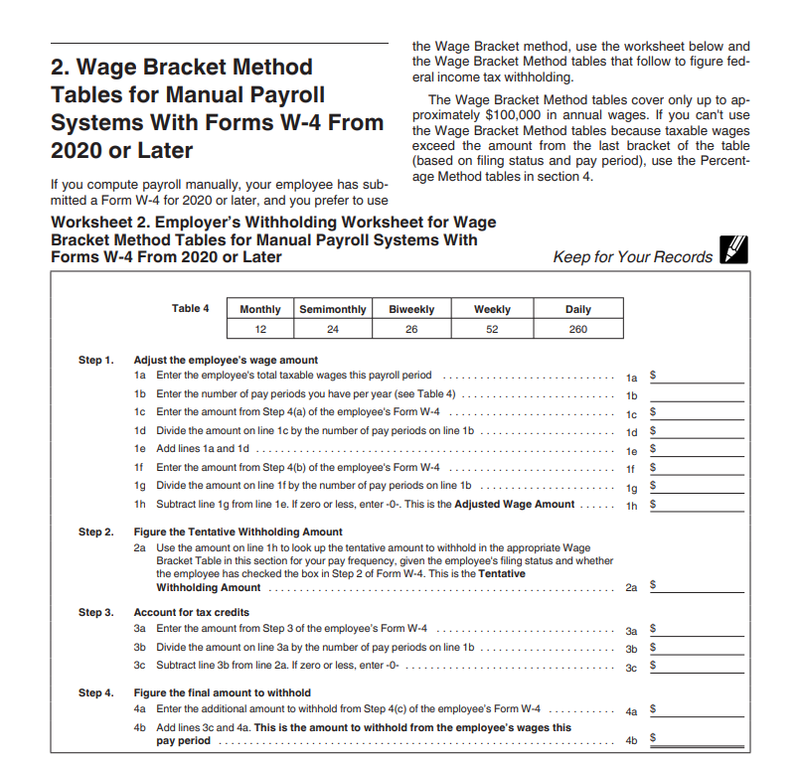

Both employers and employees are responsible for payroll taxes. Also known as Publication 15. The table below contains updates for payroll tax rates limits and minimum wage rates that may affect your firm and your clients and specifies the Accounting CS version and date on which these changes were implemented in the application.

Direct Deposit Enrollment and Authorization Form. That is to ensure that they are compliant with federal and state payroll tax regulations that may assist you in avoiding a costly audit in the future. Easily manage your HR and payroll in one place with our platform.

University of California San Francisco 1855 Folsom Street Suite 425 San Francisco CA 94103. As ADP files your taxes you should process these payrolls at least 48 hours before the check date to allow ADP enough time to debit and deposit the tax amounts timely. Dockworker Self-Service Portal previously called ILWU Worker Self-Service Portal Pay Shortage Claim Form.

The UI maximum weekly benefit amount is 450. In addition to federal regulations ADP. You can use the following mailing address.

Which address should I use. 2019 Payroll Week Calendar. You have two ways to get an.

If your federal tax liabilities for the bonus payroll are over 10000000 the taxes must be deposited the business day after the check date. The UI tax rate for new employers is 34 percent 034 for a period of two to three years. Whether youre paying business or personal taxes the CRA credits your payment same-day when using Plastiq.

All-in-one and easy to use. Includes due dates for payroll forms tables to calculate tax withholding a summary of. ACCUCHEX was founded in 1990 in San Rafael California and over the last 25 years has developed a reputation as a premier provider of comprehensive workforce management solutions including payroll processing payroll tax services Time and Attendance management insurance and employee benefits and human resource outsourcing.

Minimize HR headaches so you can get back to business. Contact the Health Service System directly at 658 652-4700 prior to electing a refundObtain an estimate of my retirement benefit. 2022 2021 Social Security Tax Maximum Wage Base 147000 142800 Maximum Social Security Employee Withholding 911400 885360 Social Security RateEmployer 62 62 Social Security RateEmployee 62 62 Medicare Tax Maximum Wage Base No limit No limit.

Accepting a refund of your retirement contributions terminates your claim to any future benefit from the San Francisco Employees Retirement System. Beginning on April 1 2018 departments are. Summary of Payroll Tax Limits FEDERAL INSURANCE CONTRIBUTION ACT FICA.

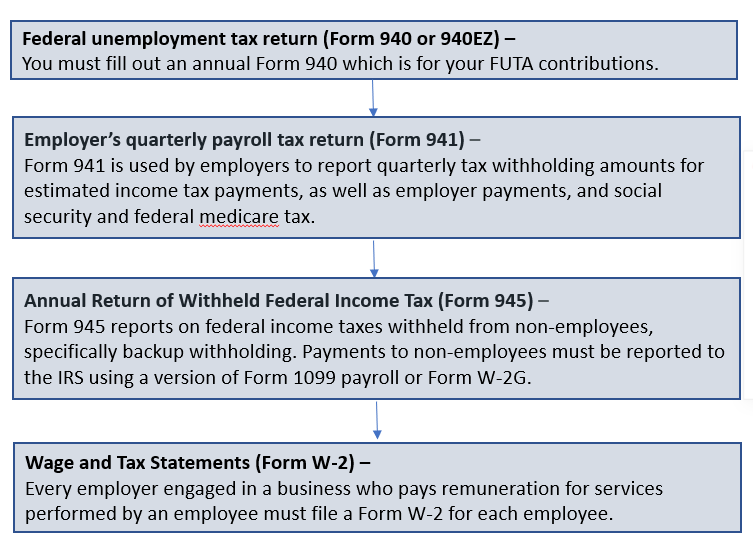

An employers tax guide written by the IRS. PDF 205K FAQs Frequently Asked Questions Payroll Self Service. This training session will cover the top ten mistakes of payroll professionals and how to fix them.

Review For 941 W-2 And W-4. 115-97 signed into law on December 22 2017 changed the taxability of some non-cash awards and other gifts provided to employees. This links to the Payroll Self Service login page.

My tax preparation software asks me to put in my employers street address but I do not see that on my W2 for 2020 and prior years. Legacy Tax and Resolution Services is a premiere tax relief and tax services company with over 20 years experience in the tax planning and tax resolution field and has the expertise to handle any of your IRS Tax problems. Unemployment Insurance UI The 2022 taxable wage limit is 7000 per employee.

Additional fees apply for e-filing state returns. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Backup withholding is when the taxpayer is required to withhold at a rate of 24 to ensure the IRS receives the taxes on income by the required due date.

Use the Search field to search the table data or click a column heading to sort the table. If an award or gift or portion of an award or gift is taxable applicable income tax withholding and FICA taxes will be deducted from the employees paycheck. If you are an individual for income tax purposes this includes any type of.

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Payroll And Tax Compliance For Employers Aps Payroll

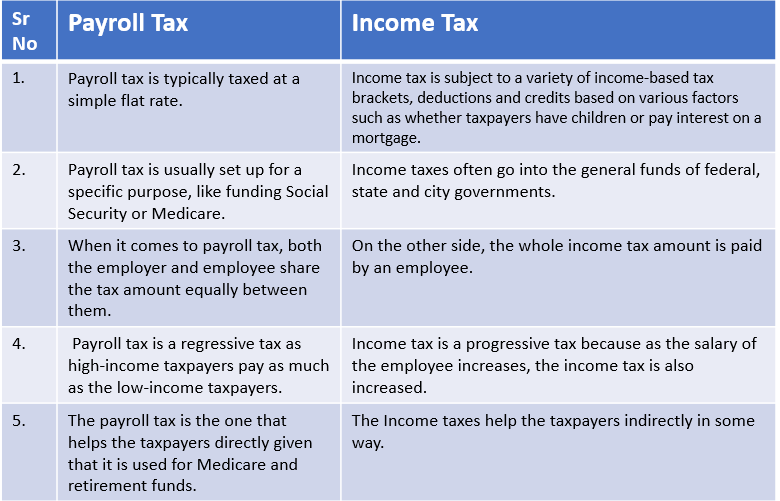

Payroll Tax Vs Income Tax What S The Difference The Blueprint

What Is The Difference Between Payroll Tax Income Tax

Different Types Of Payroll Deductions Gusto

Payroll And Tax Compliance For Employers Aps Payroll

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Payroll And Tax Compliance For Employers Aps Payroll

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa

Payroll Compliance And Tax Filing Services Rippling

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Payroll Tax Vs Income Tax What S The Difference The Blueprint

Payroll And Tax Compliance For Employers Aps Payroll

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Us Payroll And Taxes The Complete Guide To Running Payroll In The Usa